Automated Forex trading has revolutionized the currency exchange market, providing traders with advanced tools and techniques to maximize their profit potential. As technology continues to evolve, traders are increasingly relying on automated systems to analyze the market and execute trades. This article will delve into the fundamentals of automated Forex trading, its advantages, and its potential downsides, as well as the tools available for traders. Additionally, we will discuss the importance of selecting the right broker, such as automated forex trading Turkey Brokers, for a successful trading experience.

Understanding Automated Forex Trading

Automated Forex trading refers to the use of computer programs and algorithms to execute trades based on predetermined criteria. These systems can analyze market conditions and trends, allowing traders to benefit from currency fluctuations without constantly monitoring the market. Automated trading can range from completely hands-off systems to semi-automated setups, where traders still have a degree of control.

The Advantages of Automated Forex Trading

1. **Elimination of Emotional Bias**: One of the primary benefits of automated trading is the removal of emotions from the trading process. Traders often make decisions based on fear or greed, leading to costly mistakes. Automated systems adhere strictly to their programmed strategies, eliminating impulsive decisions.

2. **Efficiency and Speed**: Automated trading systems can analyze vast amounts of market data in real-time, making split-second decisions that would be impossible for a human trader. This efficiency can lead to more profitable trades and reduced slippage.

3. **24/5 Trading**: The Forex market operates 24 hours a day, five days a week. Automated trading systems can execute trades at any time, enabling traders to capitalize on international market movements while they sleep or attend to other responsibilities.

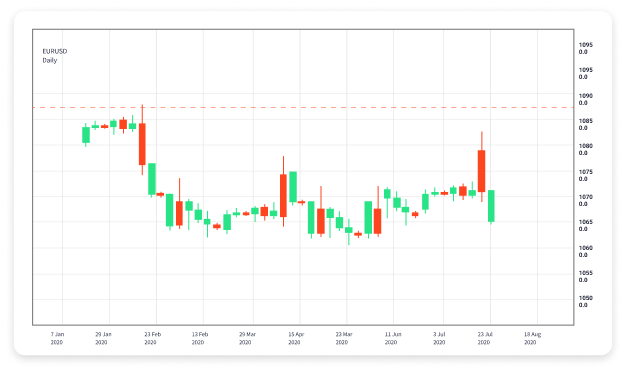

4. **Backtesting Capabilities**: Traders can backtest automated strategies using historical data to determine their effectiveness before deploying them in live trading. This feature allows traders to optimize their strategies for better performance.

5. **Diversification**: Automated trading systems allow traders to manage multiple accounts or trade various currency pairs simultaneously. This diversification can help reduce overall risk and increase profit potential.

Challenges and Considerations

While the benefits of automated Forex trading are compelling, there are also challenges associated with it. Understanding these challenges is crucial for anyone looking to enter this dynamic trading environment.

1. **Technical Issues**: Automated trading relies on technology, and technical glitches can occur. Internet outages, software bugs, and server issues can disrupt trading and potentially lead to losses.

2. **Over-Optimization**: Traders risk over-optimizing their strategies based on historical data, which may not be indicative of future performance. Striking a balance between optimizing a strategy and ensuring its robustness in real-market conditions is essential.

3. **Market Conditions**: Automated systems may struggle in highly volatile or unpredictable market conditions. Sudden news events or economic changes can lead to unexpected price movements, impacting the effectiveness of automated strategies.

4. **Cost**: Some automated trading systems can be expensive to purchase or subscribe to. Additionally, traders should factor in costs associated with spread, commissions, and slippage when assessing the profitability of an automated strategy.

Getting Started with Automated Forex Trading

For those interested in starting with automated Forex trading, here are some steps to guide you through the process:

1. **Educate Yourself**: Understanding the fundamentals of Forex trading and the various strategies available is crucial before diving into automated trading. Take courses, read books, and engage with community forums to build your knowledge base.

2. **Choose the Right Broker**: Selecting a reliable broker is paramount for successful automated trading. Look for brokers that support automated trading platforms, offer low spreads and commissions, and provide robust customer support. Ensure that the broker is regulated and has a good reputation in the industry.

3. **Select the Right Trading Software**: Numerous automated trading platforms are available, each with its features and capabilities. Popular options include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Compare them based on ease of use, features, and community support.

4. **Develop or Acquire a Trading Strategy**: A well-defined trading strategy is essential for automated trading success. You can either develop your strategy or purchase algorithmic trading systems from third-party developers. Ensure that the strategy has been thoroughly tested and is adaptable to changing market conditions.

5. **Backtest and Optimize**: Before deploying a trading strategy in a live environment, it is critical to backtest it using historical data. This process helps evaluate the strategy’s performance and identify areas for improvement. Remember to optimize cautiously to avoid overfitting.

6. **Monitor and Adjust**: Even though automated trading systems perform autonomously, it is important to monitor their performance regularly. Market conditions can change, and adjustments may be necessary to maintain profitability. Be prepared to tweak your strategy based on performance feedback.

Conclusion

Automated Forex trading presents an exciting opportunity for traders to leverage technology in their trading endeavors. By understanding the benefits and challenges associated with automated systems, aspiring traders can make informed decisions that enhance their trading strategies. With the right broker and a solid automated trading strategy, traders can maximize their potential in the ever-changing world of Forex trading. Remember, automation can be a powerful ally, but it is essential to remain engaged and informed in this fast-paced environment.

by Angerfist

by Angerfist