Learn Forex Trading Step by Step

Forex trading can seem daunting, but with the right approach and knowledge, anyone can become a successful trader. In this guide, we will walk you through the entire process of learning Forex trading, from understanding the basics to developing advanced strategies. If you’re also looking for reliable platforms to trade with, check out the learn forex trading step by step Best Vietnamese Brokers.

1. Understanding Forex Trading

Forex, or foreign exchange, is the market where currencies are traded. It’s the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, the Forex market operates 24 hours a day, five days a week, providing ample opportunities for traders around the globe.

The key elements of Forex trading include understanding currency pairs, pips, lots, and leverage. A currency pair consists of two currencies, with the first being the base currency and the second being the quote currency. Pips indicate the smallest price movement in the market. Lots represent the size of your trades, while leverage allows you to control larger positions with a smaller amount of capital.

2. Setting Up a Trading Account

To start trading Forex, you’ll need to choose a broker and set up a trading account. Factors to consider when selecting a broker include regulation, trading fees, customer support, and available trading platforms. Once you choose a broker, you can open a demo account to practice trading without risking real money.

After you feel comfortable with the demo account, you can switch to a live account. Make sure you understand the different account types available, including standard, mini, and micro accounts, as these will affect your trading experience.

3. Learning Trading Strategies

Successful Forex trading requires a solid trading strategy. There are various strategies you can adopt, including:

- Scalping: A short-term strategy focused on small price movements.

- Day Trading: Buying and selling currencies within the same day to capitalize on intraday market movements.

- Swing Trading: Holding positions for several days or weeks to benefit from expected price movements.

- Position Trading: Taking long-term positions based on fundamental analysis and market trends.

It’s essential to backtest your strategies using historical data and demo accounts to identify what works best for you. Remember, no single strategy is guaranteed to work in every market condition.

4. Analyzing the Market

Analysis is a critical part of Forex trading, as it helps you make informed trading decisions. There are two primary types of analysis: fundamental analysis and technical analysis.

Fundamental Analysis

This involves analyzing economic indicators, central bank policies, and geopolitical events that can impact currency values. Key indicators to watch include GDP, unemployment rates, inflation, and interest rates, among others.

Technical Analysis

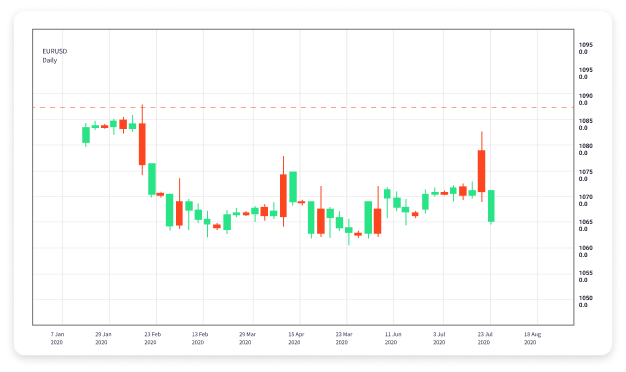

Technical analysis focuses on price charts and patterns to predict future price movements. Traders use various tools, such as moving averages, trend lines, and candlestick patterns, to identify entry and exit points for their trades. Learning to read and interpret these indicators is crucial for effective trading.

5. Risk Management

No matter how skilled a trader you become, risk management is crucial for long-term success. Effective risk management strategies can help you protect your capital and maintain sustainable profits. Here are some tips:

- Set Stop Loss Orders: Always use stop-loss orders to limit potential losses. This automatically closes your position if the market moves against you.

- Position Sizing: Determine the size of your trades based on your account balance and risk tolerance. Never risk more than a small percentage of your total capital on a single trade.

- Diversification: Spread your investments across different currency pairs to minimize risk.

6. Continuous Learning and Improvement

The Forex market is constantly evolving, and so should your trading skills. Stay updated with market news, participate in trading forums, and read books on Forex trading strategies. Consider following successful traders and analysts online to gain insights into their approaches. Moreover, keep a trading journal to record your trades, analyze your performance, and identify areas for improvement.

7. Making the Transition to Live Trading

Once you feel confident with your skills in the demo environment and have developed a solid trading plan, it’s time to transition to live trading. Start with a small amount to test your strategy and emotional discipline in a real trading environment. As you gain more experience and confidence, you can gradually increase your trading size.

Conclusion

Learning Forex trading is a journey that requires dedication, continuous education, and practice. By following this step-by-step guide, you can build a strong foundation for becoming a successful Forex trader. Remember, the key to long-term success is not just in making profitable trades but also in managing risks effectively and maintaining a disciplined approach.

Start your journey today, and with persistence and effort, you can reach your trading goals!

by Angerfist

by Angerfist